The Right Time to Buy Dental Equipment: Debunking Tax Myths

Rob Brenneise, Glidewell’s vice president of sales, CAD/CAM, at the 2019 CDA Presents convention in Anaheim, California.

As the leader of Aprio’s National Dental Industry Practice, Brad McKeiver, CPA, MBA, works as a business advisor to the dental profession, guiding dentists to make informed decisions about practice expenditures in order to maximize profitability. Chairside® magazine spoke with him to gain his valuable perspective on how doctors should approach the concept of tax savings, including what works and what are outdated approaches.

THE Q4 PURCHASE MISCONCEPTION

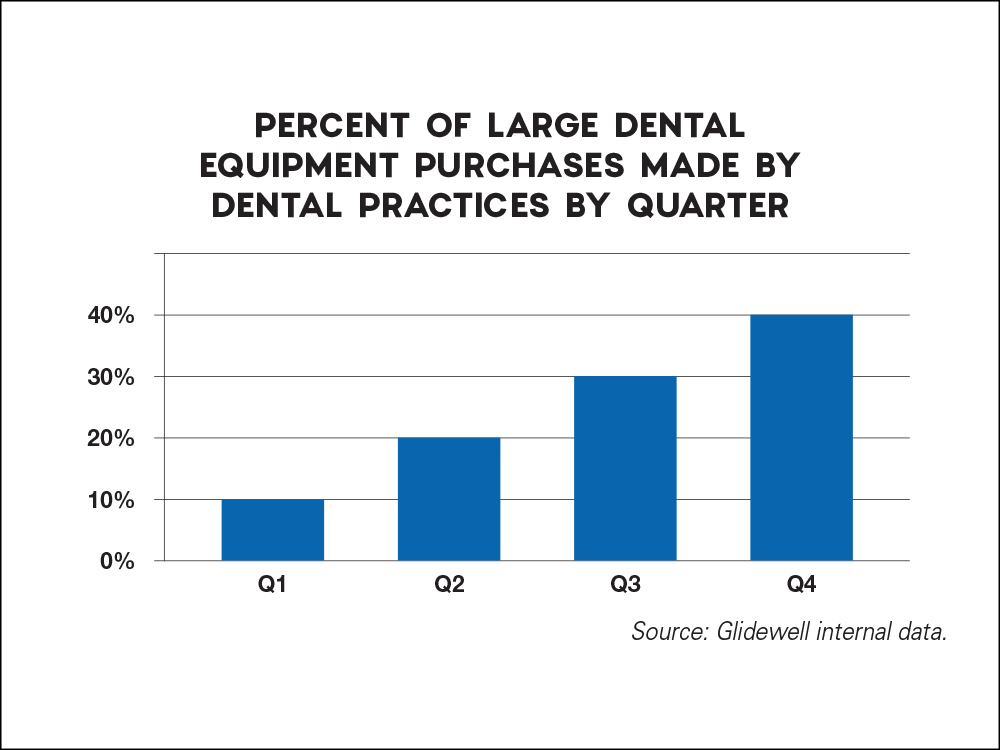

There is a common misconception that large equipment purchases for the practice should be postponed until the fourth quarter of the year in order to receive the maximum tax benefit. In fact, this misconception is so widespread that most dental equipment companies report that more than 40% of sales occur in the fourth quarter.

For an experienced accountant like Brad McKeiver, the source of this misunderstanding is easy to trace.

“It’s a matter of focus,” McKeiver says. “At the end of the year, the numbers are in and time is short if you want to reduce your taxes, because any expenses must be incurred by December 31 to be tax-deductible for that year. This might suggest a lack of proactive tax planning, so when faced with this situation, equipment is a primary area doctors look at to try and make these savings happen, as it can help grow revenue as well as lower taxes.”

Investing in in-office CAD/CAM systems like the glidewell.io™ In-Office Solution earlier in the year affords numerous advantages, including more stable finances, greater availability of staff for training, and generation of additional revenue and savings for the practice throughout the year.

The decrease in taxes isn’t caused by the time of purchase. Instead, it’s due to a purchase decision made deliberately at the end of the year, after the tax amounts are estimated and adjustment may be desired.

“A very common way to reduce taxes is to add equipment to your practice and elect accelerated depreciation for it,” McKeiver adds. “Some doctors may even preorder supplies and lab cases for upcoming procedures in the new year prior to the end of the current one. But it’s important to note that the financial benefits of the new equipment could be even greater if it had been purchased earlier in the year.”

Average sales numbers for large equipment purchases by dental practices reflect the belief that expenditures made late in the year help reduce taxes.

AVOID WAITING FOR Q4 TO BUY

Since waiting until Q4 to purchase does not, in fact, provide any additional tax benefits compared to purchases made during the rest of the year, doctors can take advantage of greater flexibility in timing their purchases. In fact, according to McKeiver, it’s a good idea for doctors to consider their financial schedules and plan purchases for different times of the year that would be beneficial to them in other ways:

- Spreading out purchases throughout the year can help keep finances more stable than having large expenditures in December. By planning new equipment purchases throughout the year, expense ratios can be more carefully maintained.

- Purchasing new technology for the practice usually requires training and commitment from the doctor and staff, which is more difficult to accomplish at year-end with so many competing practice and social commitments. It makes more sense to schedule the purchase around a slower time of year, when resources can be directed toward training.

- Many equipment purchases assist in generating additional revenue for the practice. If you are going to generate new cases with an in-office mill, the sooner you start, the sooner your production will reflect the increase.

- In cases where the equipment being purchased will provide a more streamlined, cost-efficient workflow, the sooner one buys, the sooner the savings begin to add up.

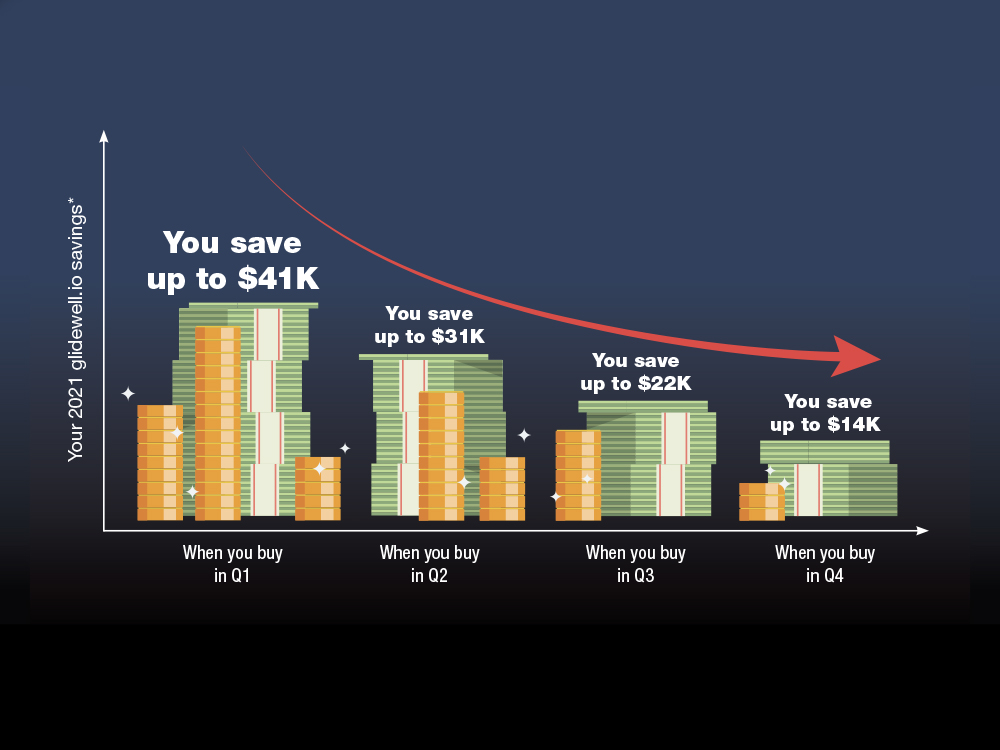

Purchasing the glidewell.io In-Office Solution earlier in the year results in a much greater amount of laboratory savings than a Q4 purchase could provide.

In fact, as is the case when a doctor purchases the glidewell.io In-Office Solution, making the investment earlier in the year saves the doctor more money overall than the tax savings alone would have done had the purchase been made in Q4. This is illustrated by an examination of the numbers themselves (see image above).

Therefore, a purchase in Q1 not only saves the same amount on taxes as a purchase in December would, but it also significantly increases the ongoing savings on your lab bills. Even more importantly, the earlier purchase will provide additional production due to the ability to offer same-day crowns.

CONCLUSION

McKeiver advises doctors to abandon the concept of Q4 equipment purchases to maximize tax savings. “If you step back and think about that Q4 planning process, it’s one that’s repeatable year-round,” he says. “By reviewing their profit-and loss data regularly with their financial advisors, a practice owner can build a monthly tax budget and analysis, and combine that with their practice planning to create a year-round view of tax strategy.”

As for purchases such as the glidewell.io In-Office Solution, doctors will make their best financial moves by calculating how much more they’ll save when they purchase earlier in the year. Purchasing as soon as possible in the year, rather than waiting for Q4 to come around, will provide the greatest savings.